Understanding the Latest Updates on Federal Repayment Plans

Introduction to Federal Repayment Plans

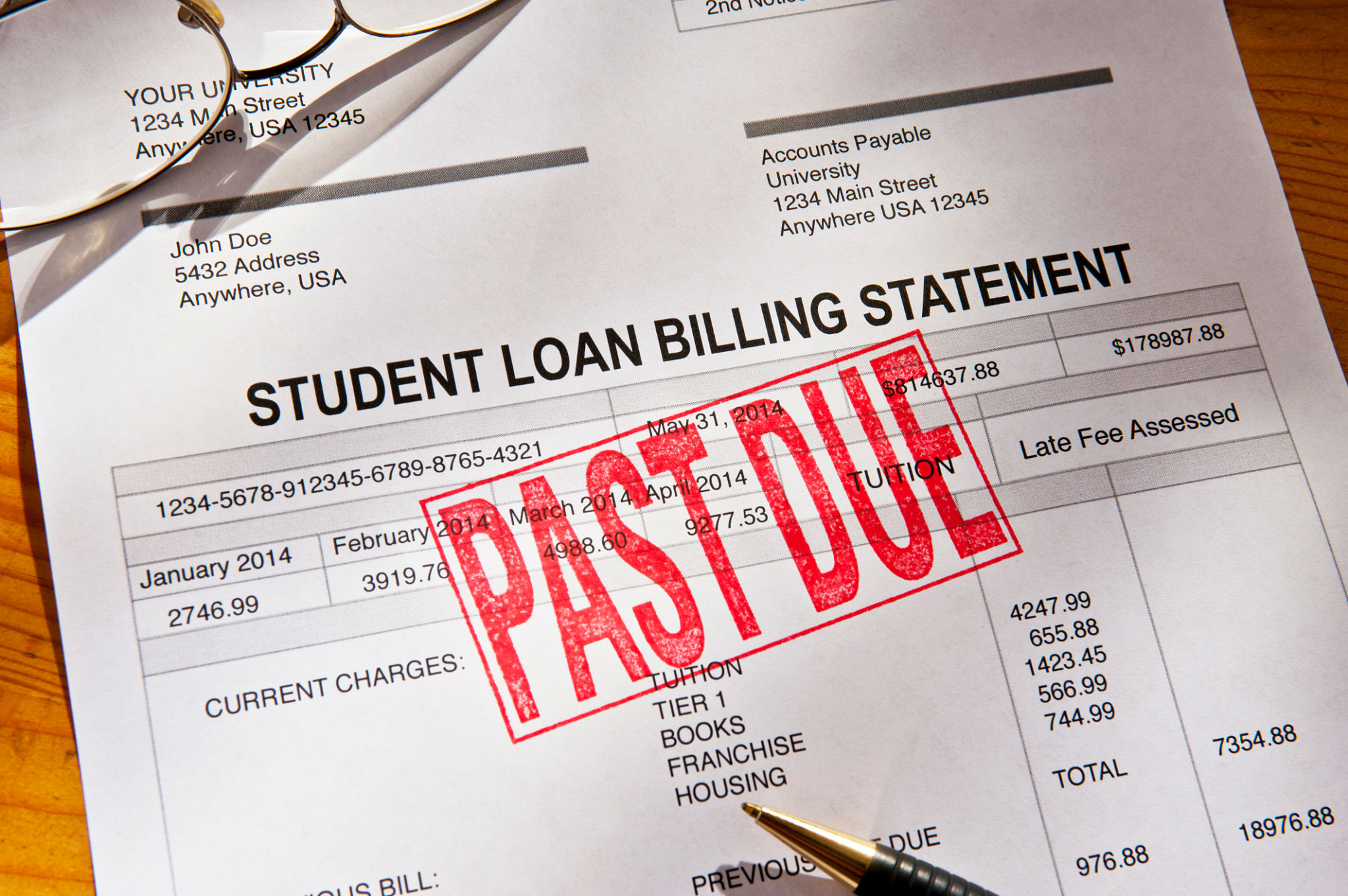

As the landscape of student loans continues to evolve, understanding the latest updates on federal repayment plans is crucial for borrowers. These updates aim to provide more flexible and manageable options for repaying student loans, ensuring that financial burdens do not overshadow personal and professional growth.

Whether you're a recent graduate or a seasoned professional with student debt, staying informed about these changes can significantly impact your financial planning and stability. Let's delve into what's new and how these updates can benefit you.

The Rise of Income-Driven Repayment Plans

Income-driven repayment plans have gained traction as a popular option for borrowers seeking flexibility. These plans adjust your monthly payment based on your income and family size, offering a personalized approach to loan repayment.

Types of Income-Driven Plans

There are several types of income-driven repayment plans available:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Each plan has its own set of eligibility criteria and benefits, so it's essential to understand which option aligns best with your financial situation.

Recent Changes to Federal Repayment Plans

The federal government has introduced several changes aimed at making repayment more accessible and less burdensome for borrowers. One notable update is the reduction of the discretionary income percentage required for payments under some plans, which can significantly lower monthly payments.

Expanded Eligibility and Benefits

Eligibility for certain repayment plans has been expanded, allowing more borrowers to qualify. Additionally, changes in forgiveness criteria mean that borrowers may reach loan forgiveness sooner, depending on their repayment history and plan selection.

Navigating the Application Process

Applying for a federal repayment plan can be straightforward if you follow the right steps. Start by gathering all necessary documentation, such as your tax returns and income information. Utilize the Federal Student Aid website to explore your options and submit your application.

Utilizing Online Resources

The online portal provides valuable resources, including calculators to estimate your payments under different plans and detailed instructions on completing the application process. These tools can help you make informed decisions about the best plan for your needs.

Conclusion: Making Informed Decisions

Understanding the latest updates on federal repayment plans is essential for managing your student loans effectively. By staying informed and taking advantage of available resources, you can choose a repayment plan that aligns with your financial goals and provides relief from student debt.

As policies continue to evolve, keep an eye on further developments to ensure you are always in the best position to manage your loan obligations. Empower yourself with knowledge and step confidently into a future free from financial stress.