How to Manage Student Loans During the Holiday Season: Budgeting Tips

Understanding Your Student Loan Obligations

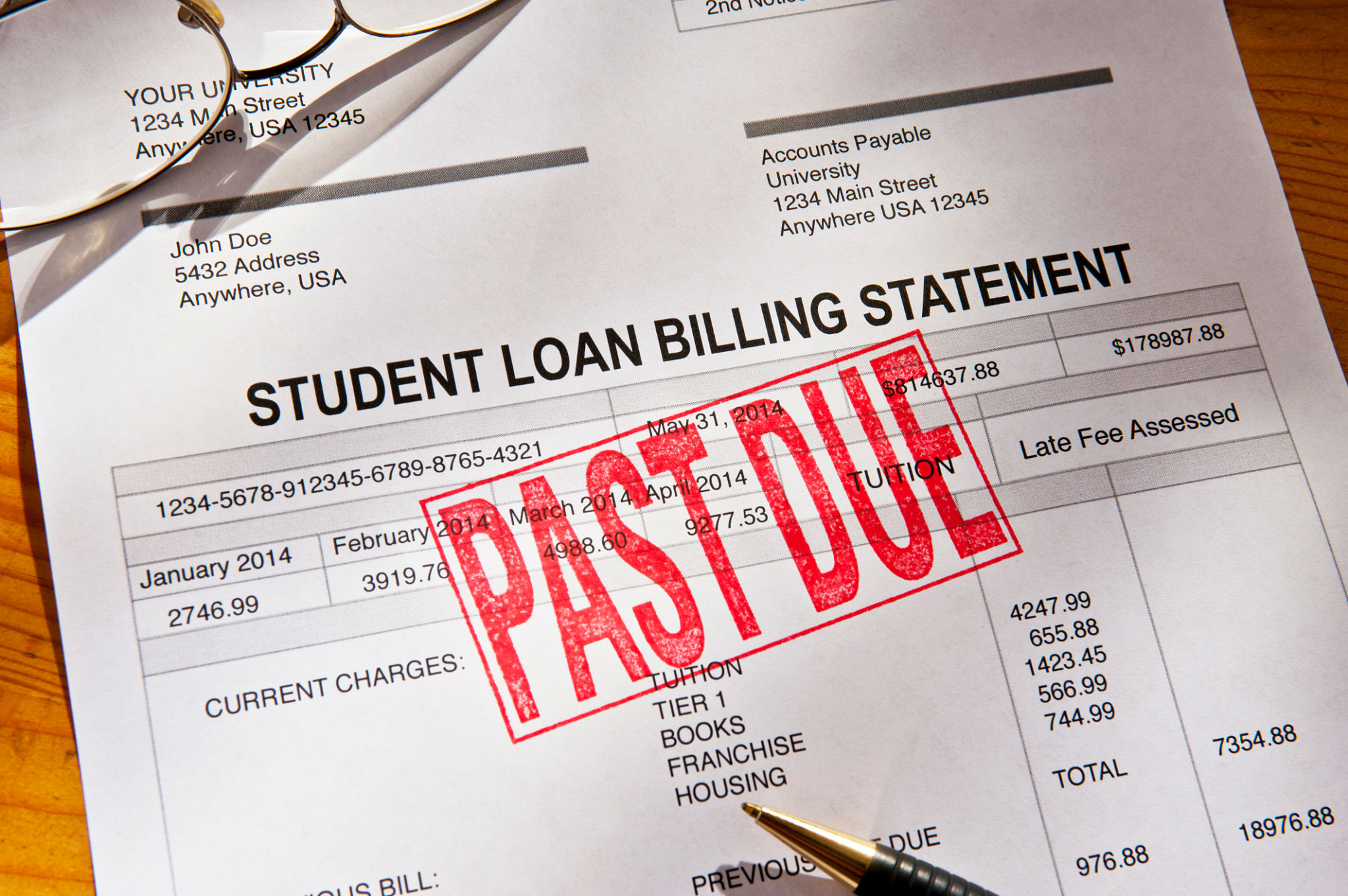

As the holiday season approaches, it's easy to get caught up in the festivities and forget about financial responsibilities, such as student loans. Understanding your loan obligations is crucial to effectively manage your finances during this busy time. Start by reviewing your loan details, including interest rates and repayment terms, to ensure you're on track.

Consider using online tools or apps to keep all your loan information in one place. This will help you track your payments and avoid any missed deadlines. Staying informed is the first step toward effectively managing your student loans year-round.

Creating a Holiday Budget

Creating a budget specific to the holiday season is essential for maintaining financial stability. Begin by listing all your expected expenses, including gifts, travel, and holiday gatherings. Compare this with your monthly income to determine how much you can realistically spend without jeopardizing your student loan payments.

Consider setting a spending limit for each category in your budget. This will help you prioritize and avoid overspending. Remember, sticking to a budget doesn't mean you can't enjoy the holidays; it simply means making thoughtful decisions about where your money goes.

Allocating Funds for Loan Payments

To ensure your student loans remain a priority, allocate a portion of your budget specifically for loan payments. Set aside this amount before making any other holiday-related purchases. This proactive approach will help you avoid falling behind on payments, which can lead to penalties or increased interest rates.

Smart Shopping Strategies

One way to manage expenses during the holiday season is by adopting smart shopping strategies. Take advantage of sales, discounts, and cashback offers to maximize your savings. Additionally, consider purchasing gifts early to avoid last-minute price hikes or impulse buys.

Another effective strategy is to use cash instead of credit for holiday purchases. This can help prevent overspending and keep your budget in check. If you must use credit, ensure you have a plan to pay off the balance promptly to avoid accruing interest.

Exploring Additional Income Opportunities

If your budget is tight, consider exploring additional income opportunities during the holiday season. Part-time jobs or freelance gigs can provide extra funds to help cover both loan payments and holiday expenses. Many businesses seek temporary staff during this busy period, which can be a great way to earn some extra cash.

Additionally, consider selling unused items online or offering services such as pet sitting or tutoring. Every bit of extra income can help ease the financial strain of the holiday season and keep your student loans on track.

Maintaining Financial Discipline

The key to successfully managing student loans during the holidays is maintaining financial discipline. Stick to your budget and resist the temptation to overspend on non-essential items. Keep your long-term financial goals in mind, such as paying off your loans and building savings.

Remember that the holiday season is about spending time with loved ones and creating memories, not necessarily about how much you spend. By being mindful of your financial decisions, you can enjoy the holidays without compromising your financial health.