How to Lower Your Student Loan Payments: Tips and Tricks

Understanding Your Student Loan Repayment Options

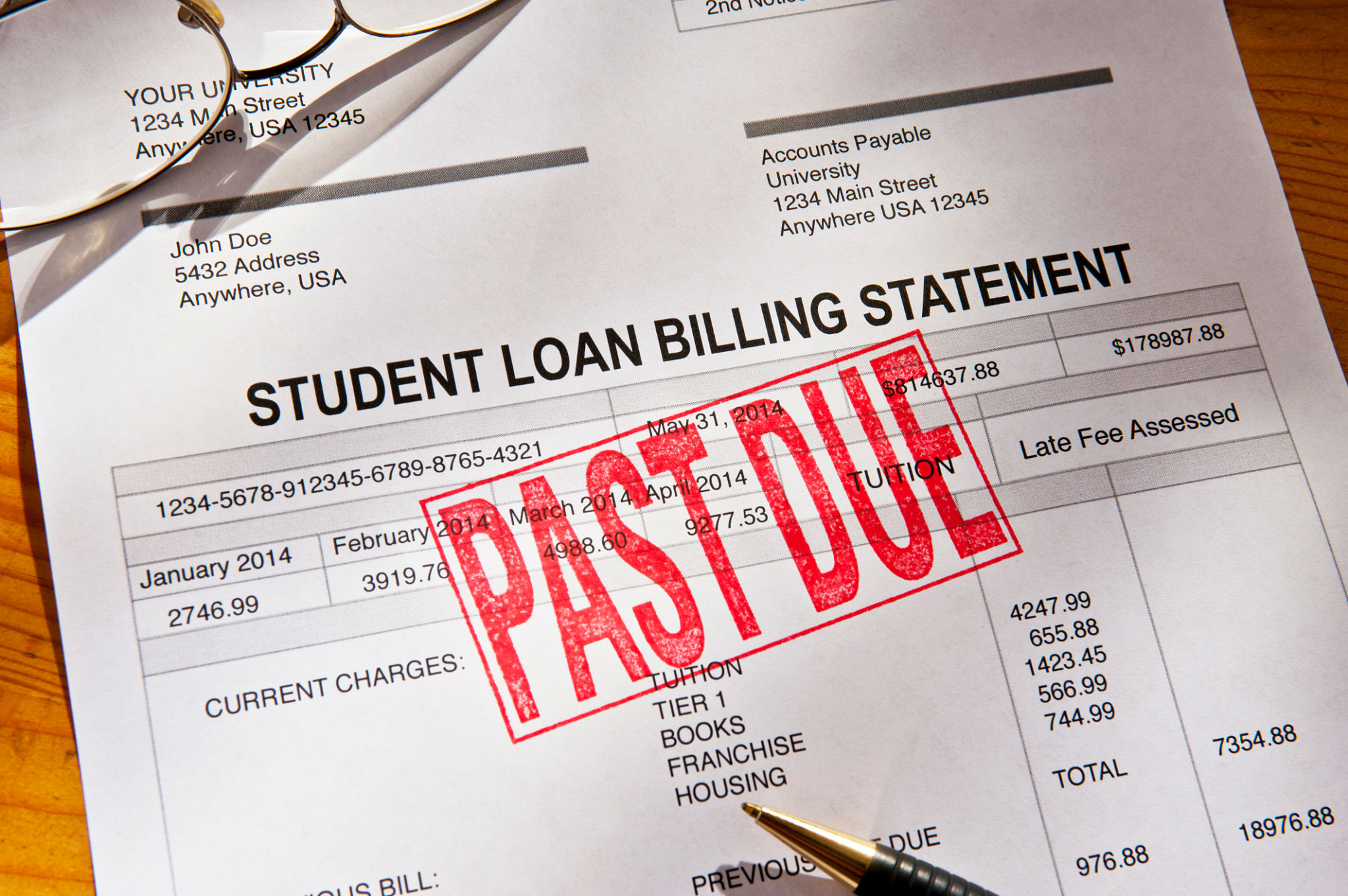

Managing student loan payments can be overwhelming, especially if you're fresh out of college and trying to establish your career. However, understanding your repayment options can help you better navigate this financial responsibility. The good news is that there are several strategies you can employ to lower your student loan payments.

Income-Driven Repayment Plans

If you're struggling with high monthly payments, consider enrolling in an income-driven repayment plan. These plans adjust your monthly payment based on your income and family size, often resulting in a lower payment than the standard plan. Programs like Income-Based Repayment (IBR) and Pay As You Earn (PAYE) are popular options. They can significantly ease the burden of repayment, especially if your income is not yet substantial.

Loan Consolidation

Another way to potentially lower your payments is through loan consolidation. Consolidation allows you to combine multiple federal loans into a single loan with a fixed interest rate. This can simplify your payments and extend your repayment term, reducing the amount you pay each month. However, keep in mind that extending the term of the loan may increase the total interest paid over time.

Exploring Loan Forgiveness Programs

For some borrowers, loan forgiveness programs offer a viable path to reducing student loan debt. These programs are typically available for individuals in specific professions or working in public service roles. Public Service Loan Forgiveness (PSLF) is one such program that forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Refinancing Your Student Loans

Refinancing your student loans can also lower your monthly payments. By refinancing, you can potentially secure a lower interest rate, which could reduce what you pay each month and over the life of the loan. However, refinancing federal loans with a private lender means losing access to federal benefits like income-driven repayment plans and loan forgiveness options.

Additional Tips to Manage Payments

Beyond the major strategies, there are additional tips and tricks to help manage your student loan payments. For instance, setting up automatic payments can often qualify you for an interest rate discount, usually around 0.25%. Additionally, making extra payments whenever possible can help reduce the principal balance and save you money on interest over time.

Budgeting and Financial Planning

Effective budgeting is essential to managing student loan payments. Create a monthly budget that prioritizes your loans while also accounting for other necessary expenses. Keeping track of your spending habits can help you identify areas where you can cut back and allocate more funds towards your loans.

By implementing these tips and tricks, you can take control of your student loan repayments and work towards financial freedom. Remember, the key is to stay informed about your options and proactively manage your debt for a smoother financial journey.